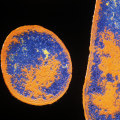

In the 1960s, an ophthalmologist from San Francisco, Alan B. Scott, was investigating a condition called strabismus, which causes people to become cross-eyed. He was interested in botulinum toxin type A, a purified form of the bacterial toxin associated with botulism. When he injected some of the substance into cross-eyed monkeys, his pupils realigned.

For the next two decades, Scott and another researcher studied the use of the toxin for cross-eyed humans and, in the late 1970s, he formed a company, Oculinum, based on his research. Oculinum caught the attention of Allergan, a large producer of eye care medications based in Irvine, California. In 1991, a couple of years after the Food and Drug Administration approved Scott's drug for strabismus and another condition, Allergan purchased Oculinum. However, all the expenses have been controversial.

While Allergan's sales have grown, some investors consider R.'s entire investment to be a waste, noting that Allergan spent about seventeen percent of its revenues on R. The industry average is fifteen percent, according to the Wall Street Journal. Last year's spending accounted for only about three percent of its revenues. Valeant's strategy, which many have championed on Wall Street, has been to grow mainly through acquisitions rather than research new products.

Michael Pearson, CEO of Valeant, spoke to investors about Allergan. Valeant expected to reduce Allergan R.'s spending from around $1 billion a year to three hundred million dollars. It turns out that Actavis and Allergan had been in secret talks for months, with Pyott checking into hotels with false names for meetings. Criminal intelligence alleges that Allergan exploited its label indication of cervical dystonia (CD) to increase off-label sales of pain and headache (HA).

Allergan has also signed a Corporate Integrity Agreement (CIA) with the Office of Inspector General (HHS-OIG) of the Department of Health and Human Services. But another factor that likely attracted Pyott and others to Allergan was Actavis's promise to continue investing in research and development. Investors were dissatisfied with the performance of Allergan shares over the past year and some have called for a change. This has been so successful that Allergan now earns more income from the therapeutic uses of Botox than from cosmetics.

Under Allergan's ownership, Botulinum toxin type A was sold under the most striking brand name of Botox and attracted a following among ophthalmologists. Dublin-based Allergan specializes in medical aesthetics and eye care, both in fast-growing areas such as stomach medications and central nervous system treatments. Whitcup, executive vice president of Research and Development at Allergan, called Botox “our channeling in a vial”. Then on Monday, Allergan made it clear that the Valeant deal would probably not happen with the announcement that it had instead accepted a competing offer from Dublin-based pharmaceutical company Actavis for sixty-six billion dollars - far surpassing Valeant's highest bid of fifty-three billion dollars.